Apple faces new challenges in China

Apple Faces Mounting Challenges in the Chinese Market Amid Continued Decline in Foreign Smartphone Sales

Apple is currently experiencing one of its toughest periods in the Chinese market, facing a wave of complex challenges that threaten its position as one of the leading players in the global smartphone industry. According to data released by the China Academy of Information and Communications Technology (CAICT), a government-affiliated research institution, shipments of foreign smartphones to China—including Apple's iPhones—plummeted by 47.4% in November 2024 compared to the same period last year.

This sharp drop marks the fourth consecutive month of decline, highlighting a significant crisis in demand for foreign smartphones in the world’s largest mobile phone market. In November alone, shipments totaled only 3.04 million units, down from 5.769 million units in November 2023.

Several factors have contributed to this downturn, most notably the overall economic slowdown in China and deflationary pressures, which have negatively affected consumer spending. Consumer prices dropped to a five-month low in November, while Apple faces fierce competition from local Chinese brands—chief among them Huawei, which has made a strong comeback in the premium smartphone segment by utilizing domestically produced chips after technological restrictions were lifted.

In response to the decline, Apple broke with tradition and launched a rare promotional campaign in China, offering discounts of up to 500 yuan (approximately $68.50) on select iPhone models in an effort to revive sales momentum.

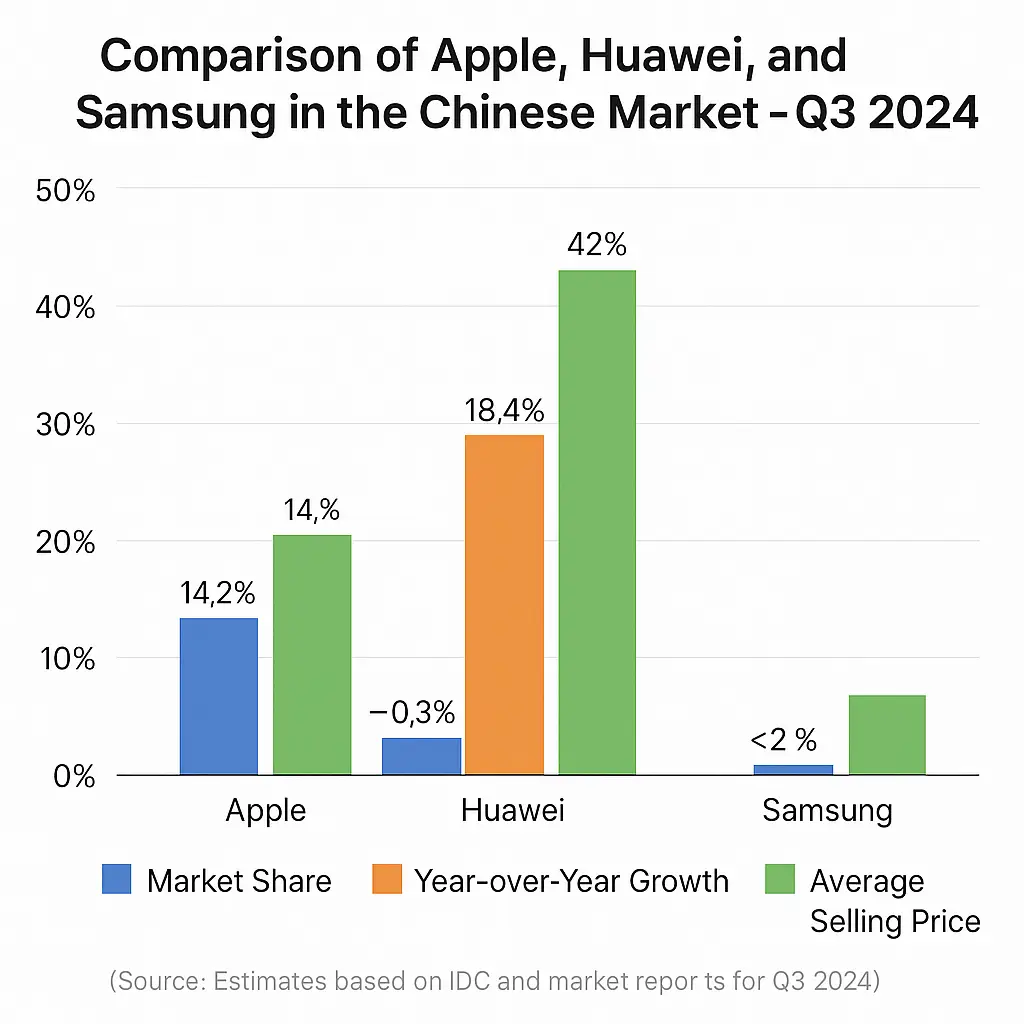

Huawei has significantly strengthened its position as a direct competitor to Apple since its robust return in August 2023. This was reflected in Q3 2024 results, where Huawei’s smartphone sales grew by 42% year-over-year, compared to a slight 0.3% decline in Apple’s sales. As a result, Apple temporarily dropped out of the list of the top five smartphone vendors in China during Q2, only to regain its spot in the third quarter.

It’s also worth noting that total smartphone shipments in China—including both foreign and domestic brands—fell by 5.1% year-over-year in November, reaching 29.61 million units. This confirms that the entire market is undergoing a slowdown, although local companies such as Huawei and Xiaomi have shown greater resilience amid the current economic challenges.

Given these developments, a pressing question remains: Can Apple adjust its strategy to keep up with the rapid shifts in the Chinese market, or is its long-standing dominance in the premium smartphone sector truly under threat?

Analysis: The Future of Apple in China and a Comparison with Samsung

Apple’s future in China stands at a critical crossroads. With continued internal economic pressures and increasing government protection and support for local companies, the Chinese market is no longer the comfortable arena it once was for foreign brands. Despite Apple’s global strength and loyal customer base, it now faces challenges that require a comprehensive reassessment of its strategy in China—especially in light of the rapid growth of local competitors in terms of innovation and pricing.

In contrast, South Korea’s Samsung has been nearly absent from the Chinese market in recent years, having lost a significant share to domestic brands. This absence may have previously worked in Apple’s favor, limiting direct competition to local brands. However, the powerful resurgence of Huawei—backed both technologically and politically—has reshaped the competitive landscape.

Nevertheless, Apple still maintains strong brand equity among users seeking luxury and reliability. But if Huawei continues to strengthen its position through the development of advanced chipsets and by offering exclusive features tailored to the local market, Apple may be forced to make greater concessions—whether by adjusting its pricing or even localizing parts of its supply chain—to keep pace with evolving market dynamics.

Ultimately, Apple’s ability to survive or grow in China will depend not only on the quality of its products, but also on its agility in understanding local market shifts and adapting to a rapidly changing political and economic environment.

Here's a visual (illustrative) chart presenting a numerical comparison between Apple, Samsung, and Huawei in the Chinese market based on the latest available data from 2024:

Comparison Between Apple, Huawei, and Samsung in the Chinese Market – Q3 2024

| Metric | Apple | Huawei | Samsung |

| Market Share | 14.2% | 18.4% | <2% (less than 2%) |

| Year-over-Year Growth | -0.3% | +42% | - |

| Units Sold | ~10.4 million | ~13.5 million | Not reported / Minimal |

| Ranking Among Top Sellers | 5th place | 2nd place | Out of top five |

| Average Phone Price | Around $850 | Around $650 | - |

Source: Estimates based on IDC data and market reports for Q3 2024

Analytical Notes:

-

Huawei has become Apple’s most prominent competitor in the premium smartphone segment, backed by domestic innovation in processors and software.

-

Samsung has sharply declined in China due to its failure to attract local consumers and offer solutions tailored to the Chinese market, shifting its focus instead to regions like India and Latin America.

-

Apple continues to hold onto its user base seeking luxury and consistent updates, but it risks losing this segment as the market shifts further toward high-value local products.